Sustainability

Our ambition as a responsible investor is to support the companies in which we invest to be sustainable in a world where social, societal and environmental issues are growing in order to make CSR a strong strategic axis, a source of innovation, value creation and a factor of differentiation.

OUR STRATEGY

Our sustainability priorities

Driving and promoting responsible investment

Accelerating our action climate change and for the preservation of biodiversity

Contributing to an inclusive and shared economy

Annual Sustainability report

Andera Partners is pleased to present its 2024 Sustainability Report

READ OUR 2024 REPORT

OUR ENGAGEMENTS

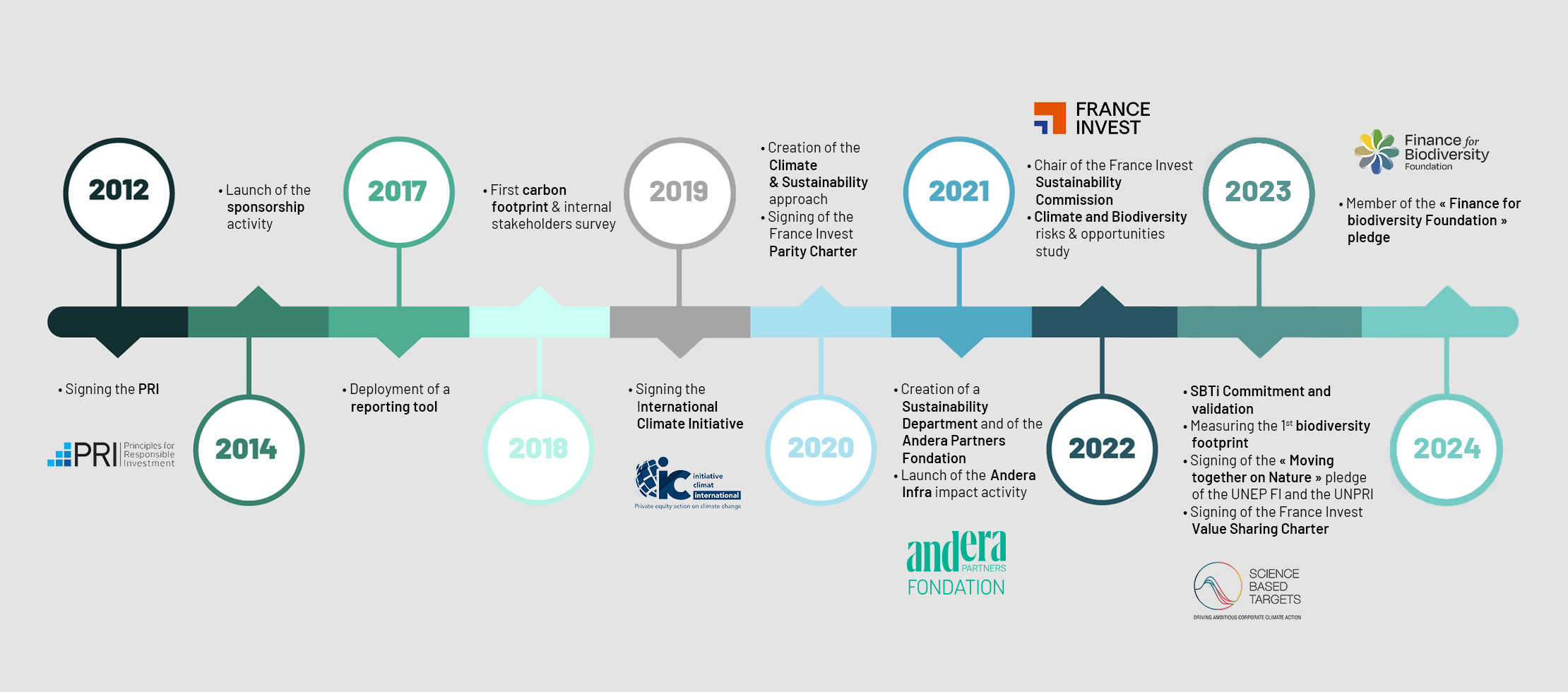

11 years of commitment

Initiatives & labels

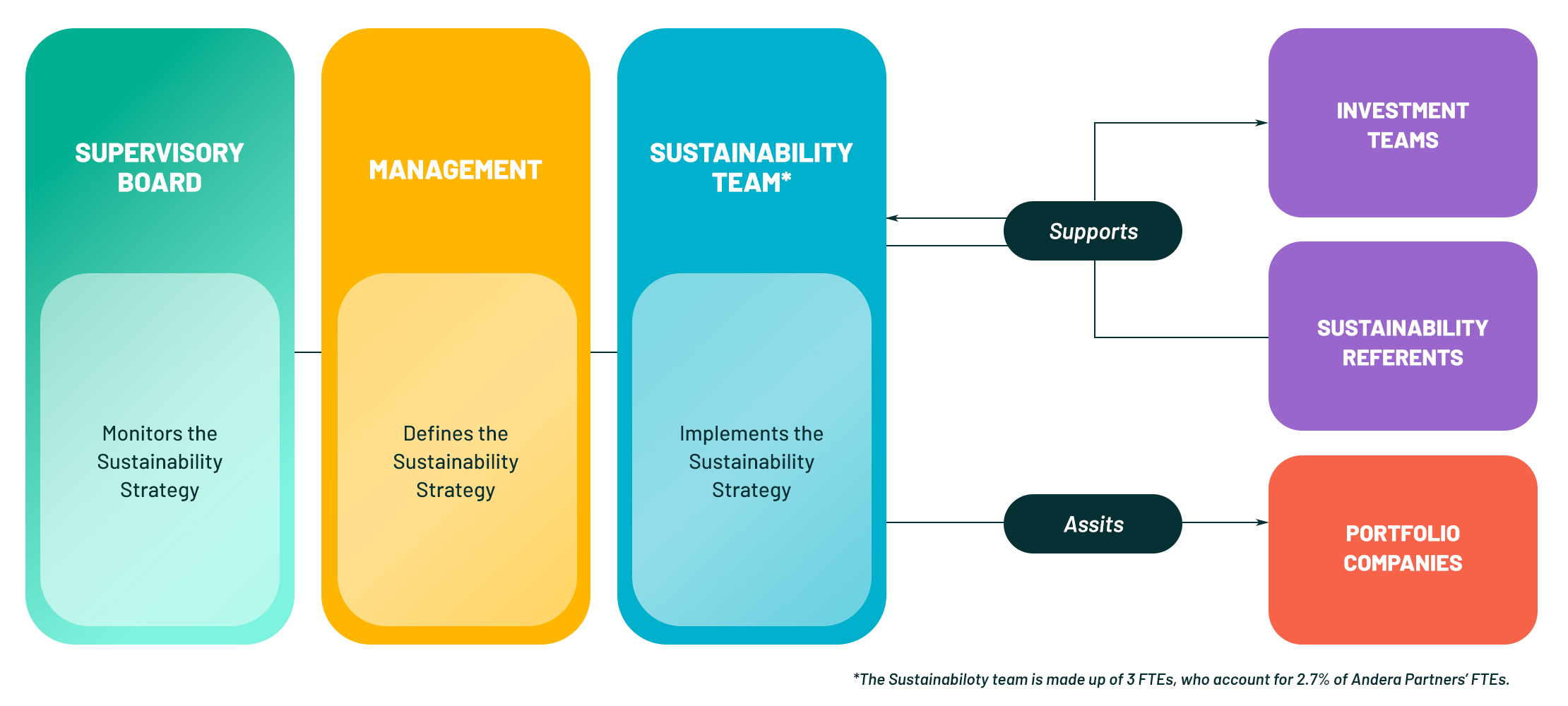

Our sustainability governance

Our sustainability approach

As an active investor with a 20-year track record of transforming the companies we invest in, Andera Partners must now be a major contributor to the challenges posed by climate change and the biodiversity crisis.

Our ambition for sustainable growth has been continuously strengthened over the past 10 years.

Each of the companies in our portfolio can, at its own level, contribute to providing sustainable solutions to preserve the ability of our societies to live on our planet.

We act on two main levers of contribution in our business:

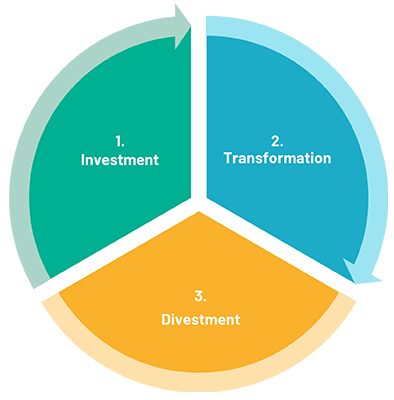

Sustainability in our investment process

Exclusions

- Application of sectoral and normative exclusions

Preliminary analysis of the opportunity

- Materiality analysis of CSR issues and potential exposure to the Sustainable Development Goals

- Study of eligibility for the European Taxonomy

Pre-acquisition due diligence

- Internal or external analysis of sustainability risks and opportunities as well as key negative impacts

- Integration of a summary of the analysis in the investment notes for discussion in the Investment Committee

Shareholder agreements

- Integration of CSR clauses

Transmission

- Provision of relevant CSR information at the time of divestment in order to value the efforts made during the holding period by the portfolio company.

Support with the implementation of a CSR approach

- Personalised support for the implementation of CSR procedures

- Carrying out a carbon footprint measurement within portfolio companies and drawing up an action plan to reduce it

Monitoring

- Annual ESG reporting including the measurement of the principal adverse impacts of investments (SFDR ‘PAIs’ indicators)

- Annual sustainability risk mapping

- Production of annual reports including the consolidation of ESG data for each fund as well as a summary sheet for each company to identify areas for progress and improvement

Our latest news

Find below all the news of the CSR team of Andera Partners: